Fourth Quarter 2025 Commentary & Outlook

Dear Clients,

I hope this letter finds you healthy and well early in the new year. Writing this letter always serves as a moment of reflection for me, and as I look back on 2025, one theme stands out in both markets and everyday life: an increasingly strained relationship between confidence and clarity.

Under normal circumstances, clarity serves as the first step to establishing confidence. We gather information, set expectations, and build conviction over time. In 2025, the reverse often became the norm.

That reversal is familiar in everyday life. We see it each year with New Year’s resolutions, where enthusiasm arrives swiftly and clarity about what is sustainable tends to follow more slowly. I have already found myself recalibrating a resolution of my own. It reinforced for me that confidence is strongest when it follows clarity, not when it tries to get ahead of it.

Markets in 2025 followed a similar pattern, with tension often emerging between confidence and clarity. While broader indexes ultimately moved higher, the path was uneven, marked by sharp pullbacks and swift recoveries. At several points during the year, measures of market volatility spiked meaningfully, reflecting how quickly sentiment could shift even as confidence returned just as fast. This becomes very evident as we saw some significant dislocations between underlying fundamentals and prices in both directions.

This behavior was reinforced by the ease with which capital could move. Record-setting inflows of roughly $1.5 trillion into exchange-traded funds were at times followed by abrupt slowdowns and redemptions. This highlights an environment where confidence was readily deployed, questioned, and redeployed again before longer-term clarity had time to fully develop.

Importantly, periods like this do not call for reinvention. They call for discipline. While confidence and clarity may drift in and out of order in the short term, our focus remains unchanged: owning high-quality businesses, grounding decisions in fundamentals, economic moat, and maintaining a long-term perspective. That approach has served our clients well in many market environments, including this one.

Market Performance Summary

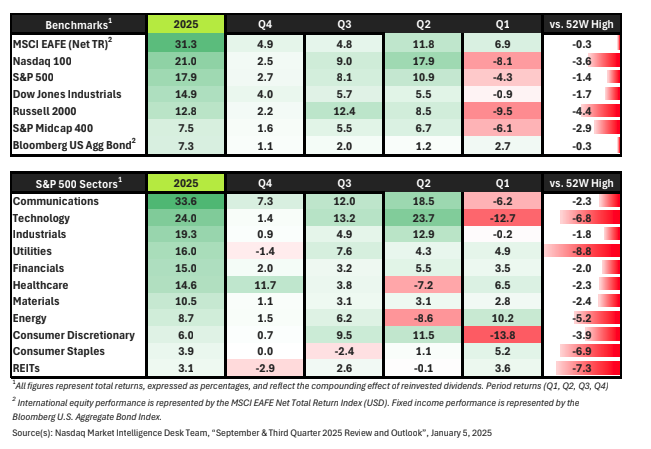

-

S&P 500 posted a third consecutive year of 15%+ gains. While the index finished 2025 resiliently, Q4 returns were more muted than earlier quarters, consistent with a period of consolidation after strong advances.

-

International developed indexes were the steadiest major area in Q4. The MSCI EAFE Index led the benchmarks, continuing a year where overseas markets outperformed U.S. markets given the USD’s tumultuous year.

-

Small caps lost momentum late in the year. After strong Q3 gains, the Russell 2000 decelerated in Q4, reflecting heightened sensitivity to interest rate expectations and more cautious central bank messaging.

-

Communication Services led sector performance. Gains remained driven by a narrow group of large-cap leaders, with market leadership staying concentrated despite signs of rotation. • Healthcare also performed well on a relative basis. The sector benefited from a rotation out of large cap tech names into the undeservedly lagging sector, reflecting a more defensive stance as we head into the new year.

-

Consumer discretionary and staples have lagged in 2025. Following years of inflation, consumers are stretched amid a slowing labor market and low consumer confidence.

U.S. Economy: Q4 2025

As many of you know, the prolonged government shutdown from October 1 through November 12 added an unusual layer of complexity to interpreting economic data late in the year. While third-quarter figures have since been revised to final estimates, providing a clearer anchor for the broader narrative, the fourth quarter remains more fragmented, with several key reports delayed or partially missing, particularly from October. That said, markets and businesses do not wait for perfect information. By pairing latest estimates from Q3 data with the best available Q4 readings, we can still draw reasonable conclusions about where the economy stood as 2025 came to a close and, more importantly, what appeared to be changing beneath the surface.

In late December, the Bureau of Economic Analysis reported initial estimates showing Q3 GDP growing at an annualized rate of 4.3%, a notable acceleration from Q2 growth of 3.8%. Consumer spending was a meaningful contributor to this strength. In this instance, two things can be true at once: while many middle and lower-income households remain stretched, higher-wealth households continued to spend through much of the second half of the year. Moody’s Analytics estimates that the top 10% of earners now account for nearly half of all U.S. consumer spending.

Where clearer signs of strain began to emerge in 2025 was in the labor market. Employment data can be difficult to interpret given how it is released and revised over time. Monthly job numbers are first estimated and then refined as additional payroll data becomes available, while benchmark revisions later align those estimates with actual payroll tax records. In a year like 2025, when the government shutdown disrupted data collection, we place greater emphasis on trends and revisions over time rather than any single month’s headline figure.

Revisions in 2025 were larger and more consistently negative than is typical in a stable year, reflecting both data disruptions from the government shutdown and a labor market that was cooling more unevenly than early estimates suggested. Big revisions, however, do not reflect weakness. They reflect the difficulty of capturing data and should not be interpreted as a warning or stress signal alone.

Looking at quarterly job growth using the latest revised data, the first half of 2025 still showed solid hiring momentum, with approximately 333,000 jobs added in Q1 and 289,000 in Q2. By Q3, however, payroll gains slowed meaningfully to around 154,000 jobs, underscoring a clear deceleration in labor demand as the year progressed. By comparison, Q3 2024 added roughly 510,000 jobs, highlighting how materially hiring momentum has cooled over the past year. Late in 2025, labor conditions became more uneven, with significant job losses reported in October followed by modest gains in November. The unemployment rate rose to 4.6% in November, the highest level in roughly four years, reinforcing the view that labor market momentum weakened as the year came to a close.

After cutting rates by 0.25% in September, policymakers emphasized that future decisions would remain data dependent rather than follow a preset path. In December, the Federal Reserve delivered its third rate cut of the year, lowering the federal funds rate by another 0.25% to a target range of 3.50% to 3.75%. The decision was approved by a 9-3 vote, reflecting meaningful disagreement among policymakers over the appropriate balance between cooling labor conditions and inflation risks. While inflation has eased from pandemic-era highs, it remained above the Fed’s 2% target, with annual inflation running near 2.7% in November. Policymakers noted that incomplete and delayed economic data complicated decision-making, particularly around employment trends, and emphasized that future rate moves would depend on clearer evidence regarding both labor market conditions and the persistence of inflation.

The Bottom Line

Growth remained resilient into late 2025, but momentum clearly slowed beneath the surface. Hiring cooled meaningfully, inflation progress remained uneven, and policymakers shifted toward caution rather than urgency. The economy appears to be normalizing rather than weakening as it enters 2026.

Looking Ahead: 2026

As always, our approach remains grounded in discipline and long-term thinking. We focus on owning a concentrated set of high-quality businesses where we believe the risk and reward are appropriately aligned, and we are comfortable being patient when opportunities are not compelling. Markets will continue to fluctuate, headlines will change, and narratives will come and go. Our job is to stay focused on fundamentals, manage risk thoughtfully, and remain aligned with your long-term goals.

In an environment where many large companies are committing substantial capital toward new initiatives, we believe it is increasingly important to focus on history rather than headlines. Not all investment spending translates into durable returns, and some of the most meaningful differences in long-term outcomes come down to how effectively a business has reinvested its profits in the past. We pay close attention to whether prior investments have produced real cash flow growth, improved competitive positioning, and higher returns on capital over time, rather than assuming future spending will automatically lead to future profits.

Thank you for your continued trust and partnership.

Regards,

Alec Campbell | Vice President & Investment Advisor