Second Quarter 2025 Commentary & Outlook

Dear Clients,

I hope this letter finds you well, and that your summer is going well. First, for those who don’t know me, this is Alec Campbell. I know that you are used to hearing from Zandy each quarter, but as our company grows, I’ll be taking the lead on this and future updates. I do not anticipate things going terribly wrong in this endeavor; in fact, they may go terribly right, but that is an unknown, an uncertainty — a word best suited to describe the first half of 2025.

Uncertainty, after all, has a strange kind of power over us. A 2011 study from the Netherlands found that just four seconds of silence in conversation was enough to make Americans feel unsettled or insecure. We’re a culture trained to avoid the “awkward pause” at all costs. Not knowing what comes next drives us up the wall — so we fill the void with something as profound as, “It’s been really hot recently.”

For investors, that same type of impulse can translate to reactionary decisions: selling on headlines, rotating out of quality too quickly, or chasing the trade of the moment. But more often than not, the right move is to pause, reflect, and think longer-term. Exiting the market can pose challenges, such as making it harder to accurately time reentry at market lows. Additionally, frequent buying and selling of assets may result in capital gains taxes that affect overall portfolio values.

That’s why our work at A.G. Campbell Advisory is centered around thoughtful discipline: cutting through the noise to focus on the signals that matter. Periods of uncertainty, uncomfortable as they may be, tend to produce some of the best long-term opportunities. This was evident in the first half of 2025. The tariff-driven volatility that shook markets in Q1 quickly subsided following the Q2 pause, as investors regained confidence in the resilience of U.S. companies. By the time many had processed the volatility, the rebound was already well underway. Markets reward those who stay patient. And that’s what we do — invest deliberately, hold high conviction, and play the long game.

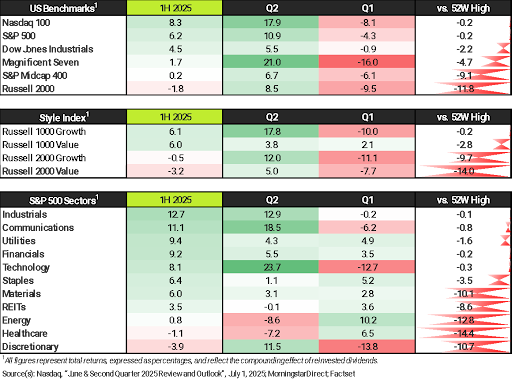

- Investor sentiment improved in Q2 as risk appetite strengthened, despite lingering macroeconomic concerns.

- U.S. equities rebounded sharply, with several major indexes hitting new all-time highs.

- Growth stocks regained leadership, reversing the Q1 trend that favored value.

- Technology stocks led all sectors, rebounding from early-year weakness with a standout +23.7% return.

- The “Magnificent Seven” regained favor, though investor enthusiasm was more selective than earlier AI rallies.

- Communication services rebounded after a weak Q1, contributing meaningfully to index-level gains.

- Small-cap growth stocks rallied, though large caps led as the Russell 1000 Growth returned +17.8% in Q2.

- Consumer discretionary stocks rebounded sharply, moving from Q1 laggards to Q2 leaders on renewed consumer optimism.

U.S. Economy (1H 2025)

Despite ongoing uncertainty around trade policy, recent data paints a picture of an economy that’s still holding up—though not without signs of strain. The Federal Reserve kept interest rates steady between 4.25% and 4.50% throughout the first half of 2025, aiming to guide the economy toward a “soft landing.” Notably, these percentages are down from a peak of 5.50% a year ago. For policymakers to consider rate cuts, they’ll need convincing evidence of continued disinflation and a gradually cooling job market.

Core consumer prices (CPI) rose 2.8% year-over-year in May, in line with the prior two months and just below expectations. The Fed’s preferred measure—core personal consumption expenditures (PCE)—ticked up to 2.7% from 2.6%, signaling progress but not quite enough to shift policy. Some inflation drivers, like shelter and auto insurance, remain sticky. Shelter costs are still up 3.9% from a year ago, and motor vehicle insurance has jumped 7%, making it one of the fastest-rising expenses.

The job market continues to show strength, with 147,000 jobs added in June and unemployment edging down to 4.1%. Still, there are signs of weakness beneath the surface. ADP reported a 33,000-job decline in private-sector employment, the first drop in over two years. Most job gains came from government hiring, and wage growth slowed to 3.7%, the lowest in nearly a year.

When looking at growth, it’s important to separate backward- from forward-looking data. Real GDP, a rearview mirror metric, shrank by 0.5% in Q1—the first contraction in three years. Much of that dip came from businesses pulling back after a surge in late-2024 inventory stocking, which was driven by efforts to get ahead of possible tariffs. That buildup lifted GDP at the time, but the Q1 correction dragged it back down. Looking ahead, economists expect a modest rebound in Q2 for GDP, with growth forecasts between 1.5% and 2.6%. At the same time, the ISM Manufacturing and Services indexes—a more forward-looking lens—continue to flash mixed signals. Manufacturing is still contracting, while services are barely growing, pointing to an uneven recovery ahead.

The Bottom Line:

The economy appears to be on stable footing, with growth in some key areas showing signs of resilience despite some pockets of weakness. Inflation is easing slowly, wage growth is cooling, and the job market—while still solid—is beginning to lose momentum in certain areas. These are the kinds of developments the Federal Reserve wants to see before considering rate cuts. But with core inflation still running above the Fed’s target of 2% and certain costs like shelter and insurance remaining stubbornly high, policymakers are likely to stay cautious until the trend becomes more convincing.

Looking Ahead: What to Watch in 2H 2025

As we look toward the second half of the year, the backdrop is clearly mixed, and the narratives continue to clash. The economy has shown more strength than many expected, especially in the labor market, and the comedown of core inflation from the 2024 highs is encouraging. Corporate earnings held up well in Q1, with S&P 500 companies growing earnings at a 12% year-over-year rate. Additionally, Q1 sales for S&P 500 companies increased 4.4%, pointing to continued profit margin expansion¹.

Still, we are not out of the woods. The recent rise in yields on the 10-year Treasury bond is notable, signaling that investors are demanding more to lend to the U.S.—a sign of cooling confidence. The U.S. carries some of the highest debt levels in the developed world and relies heavily on short-term financing and foreign capital. As rates rise, refinancing becomes more challenging, and trade imbalances are more difficult to manage. That said, the underlying strength of U.S. companies, a resilient consumer, and moderating inflation offer reasons for cautious optimism as we move through the rest of the year.

At A.G. Campbell Advisory, we remain grounded in research, selective in our equity exposure, and opportunistic when volatility creates mispricing. Our focus on quality businesses, strong balance sheets, and long-term thinking has served our clients well—and we believe it will continue to do so in the months ahead. As we head into Q2 earnings season, we’re watching for signs of resilience in corporate profits and opportunities created by short-term dislocations.

Thank you for being a valued client. We’re honored to serve you and look forward to supporting your financial journey in the years to come.

Regards,

Alec Campbell | Vice President & Investment Advisor