Third Quarter 2025 Commentary & Outlook

Dear Clients,

I hope this letter finds you well. To many people’s dismay, Summer has officially come to an end. To

others, like me, the best time of the year has just begun. I have nothing against the Summer, but I would

be lying if I told you that I enjoyed the slowdown that’s inherently intertwined.

There is something unique about the Fall that makes it special. It’s not the leaves. It’s the people. There is

an underlying sense of unity that comes with the Fall season’s pace that is rarely seen during other parts of

the year. This can be seen in all facets of life including the workplace, households, schools, and other

organized activities and curriculum.

People set out for their days with a purpose, often collaborating with others towards a shared objective.

Whether it be meeting the fast-approaching year-end deadlines, organizing a bake sale, or figuring out

which parent is on carpool duty, we work together and focus on the things within our control instead of

worrying about things out of our control.

This same principle of focus is highly relevant to investing. Volatility, headlines, and uncertainty will

always be there, but what matters is focusing on what can be controlled: owning quality businesses,

staying disciplined, and keeping a long-term perspective.

At A.G. Campbell Advisory, we agree with the perspectives set out by some of the greatest investors of our

generation. It was Warren Buffett who once said, “a true investor welcomes volatility – a wildly

fluctuating market means irrationally low prices will be attached to solid businesses.” In essence, during

times of mania, many don’t see where the clear opportunities exist. We have already begun to see these

opportunities, like United Healthcare, a compounding machine in America’s biggest industry, falling to a

five-year low valuation.

We remain diligent as these opportunities present themselves. Markets can misprice great companies, but

patience turns those missteps into opportunity. After all, an investor who held Apple through its 2008

drawdown didn’t just survive, they saw the stock compound more than 60× by 2025. That’s the power of

patience.

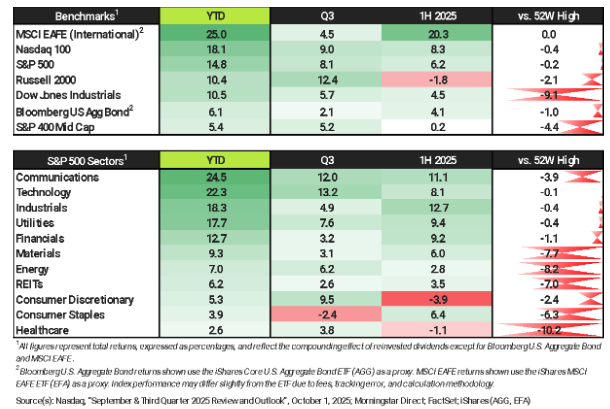

Market Performance Summary

- Equities held strength into quarter-end. September was the strongest month in nearly 15 years for the S&P 500 (+3.5%) and Nasdaq Composite (+5.6%). The rally was fueled by AI optimism, fear of missing out, and investor confidence that the Fed would provide support if needed.

- The S&P 500 and Nasdaq 100 reached new highs late in Q3. Gains in healthcare and a decline in Treasury yields after softer labor data contributed to the move.

- Earnings remained supportive. Q2 S&P 500 EPS rose about 12.7% year-over-year, and Q3 growth was still projected near 8% across most sectors.

- Small caps finally showed strength. The Russell 2000 delivered double-digit returns in Q3 as markets priced in additional rate cuts. Small caps tend to react more directly to changes in interest rate expectations.

- International developed markets outperformed year-to-date. MSCI EAFE (EFA) was near its 52-week highs at quarter-end, led by strong performance in Europe and other developed regions.

- Bonds added positive weight. The Bloomberg U.S. Aggregate gained in Q3 as yields eased. Year-to-date returns are around 6%, with levels close to the 52-week high.

- Investor flows showed lingering caution. Global equity funds recorded sizable outflows in mid-September even as indexes advanced.

- Healthcare appears to be the most attractive sector from a valuation standpoint.

U.S. Economy: Q3 2025

The third quarter brought both welcome and unwelcome surprises in a volatile year. As I write from a quiet office, the U.S. government has been shut down for 20 hours. For investors, history suggests more bark than bite: in the last five shutdowns, stocks and bonds gained in the months that followed. This time markets have shown resilience, with the S&P 500, MSCI Developed International, and MSCI Emerging Markets all closing at record highs. Still, shutdowns are a double-edged sword, with their true cost depending on duration, and another credit rating downgrade would be an unwelcome repeat of 2011 and 2023.

With data releases on hold, what we do know is that job revisions have clouded the labor picture. June’s nonfarm payrolls were revised from +179,000 to –13,000, and July was revised down to +79,000. Meanwhile, ADP data on business hiring showed losses in both August and September. Together, these reports show that hiring momentum has cooled after years of steady growth. I would not go far as to say that the labor market is “weak” at this time.

On a lighter note, the latest real GDP figure from Q2 was revised up 0.5 percentage points from the second estimate (3.8% annualized), primarily reflecting stronger consumer spending and fewer imports. This comes after a tough Q1 report showing a revised decrease of 0.6%.

Corporate earnings expectations remain resilient. Analysts now expect S&P 500 earnings to grow about 8% year-over-year in Q3, which would mark the ninth consecutive quarter of earnings growth if realized. Revenues are projected to rise around 6%, with strength in Technology, Utilities, Materials, and Financials, while Energy and Consumer Staples are expected to lag. Guidance has leaned more positive than usual, suggesting companies may be navigating softer economic data better than headlines imply. Valuations are elevated, with the S&P 500 trading near 22.5x forward earnings, but bottom-up analyst targets still point to roughly 11% upside over the next twelve months.

Against this backdrop, the Fed cut rates by 0.25% in September, its first move of the year after holding steady through the spring and summer. The decision acknowledged both softer payrolls and progress on inflation from pandemic highs, while signaling a shift toward supporting growth as the economy transitions into year-end. Even after the cut, long-term borrowing costs remained sticky, with the 10-year Treasury yield holding above 4.1% as markets weigh inflation risks and heavy government debt issuance.

The Bottom Line

Economic growth has held up better than expected, with Q2 GDP revised higher, but the labor market is showing cracks. Wage growth has cooled, though pay is still higher than a year ago. Markets expect another Fed cut in October, but with prices in areas like shelter and services still running hot and with the shutdown delaying new data, policymakers may prefer to wait.

Looking Ahead: Q4 2025

As we turn the corner into Q4, the backdrop is as mixed as it has been all year. On one hand, growth has surprised to the upside, earnings expectations remain resilient, and markets have climbed to record levels. On the other, the labor market has softened, revisions have chipped away at confidence in the jobs data, and inflation is not yet fully at target.

The fourth quarter is usually a period of seasonal strength. Holiday spending tends to lift both the economy and corporate earnings, as households shift into consumption mode and retailers see their busiest stretch of the year. This year, however, there are some new wrinkles. Another factor to watch this quarter is the strain on consumer spending from federal workforce changes. The holiday season is normally a lift for the economy, but this year many federal employees are not just furloughed. A significant number have voluntarily quit, accepted buyouts, or been cut entirely. More than 148,000 civil servants have left government this year, and over 154,000 remain on payrolls but are not actively working. This is not just a temporary pause. For many, reentry into the workforce could be challenging in a tough job market. That lost income may dampen spending in retail, travel, and services just as consumers are normally most active.

At the same time, tariffs and supply frictions have reduced imports, which can push up costs for certain goods just as consumers are most active. These pressures, alongside sticky prices in shelter and services, leave the Fed with a careful balancing act. Another rate cut is still on the table for October, but with incomplete data and fresh risks to consumer demand, a cautionary pause may be the outcome.

As always, we remain focused on what we can control: owning quality businesses, staying disciplined, and using volatility to our advantage.

At A.G. Campbell Advisory, we never forget that wealth is more than numbers on a page. It is the story of where you have come from and where you want to go. Thank you for allowing us to be a trusted partner in that journey.

Regards,

Alec Campbell | Vice President & Investment Advisor