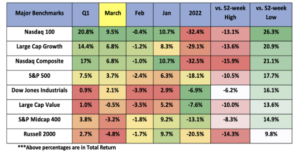

Q1 Commentary, 2023

The stock and bond market got a small amount of relief in the first quarter. Quarterly highlights included:

- Volatility and gains characterized the 1st quarter this year. Most of the gains were made in mega-cap technology stocks. Many investors have sought safety in the ‘Microsofts’ and ‘Apples’ of the world. Stocks and bonds were up in the first quarter, but the breadth of market move was very narrow.

- The Federal Reserve continues its’ mantra to keep raising rates until inflation is stopped and a return to a rate of 2%.

- The collapse of Silicon Valley Bank and Signature Bank started a fear-based contagion that was truly abated by the government’s action of reassuring depositors and putting in place temporary lending facilities to alleviate liquidity pressures.

- Commercial real estate has been pressured by rising rates. Occupancy rates have fallen, and part of this reaction is buoyed by the stay at home work model.

- Geopolitically, the world is dealing with many challenges. The war in Ukraine is far from over, and the tensions between the US and China are apparent. Many US companies are trying to get a handle on their supply chain. If companies were better able to control these supply chains, it could lead to more persistent inflation.

- Credit at banks begins to tighten as the corporate world is bracing for potentially weaker earnings reports and tougher lending standards. All of this information certainly seems to point to some kind of oncoming recession.

In summary, most individuals and institutions seem unwilling to make bigger commitments without knowing if the Fed will pause raising rates. Higher interest rates generally cause stocks and bonds to move inversely. In this area, the jury is out. Finally, we foresee more volatility in the second quarter and recommend maintaining current cash levels and investments.

Warmest Regards,

Zandy Campbell